Practical Recommendations On Effective Loan Secrets

Financing is often offered in amounts of $1,000 to $30,000. If you ever more than that, for example, $50,000 to $100,000, you could find it difficult to obtain an unsecured loan. Definitely will most likely need a loan that is secured against your at home. It should be noted that, most lenders will only provide a secured loan, of this amount to some homeowner, in which has a lots of equity associated with home. You are borrow over the equity in residence. The rule is typically 60% loan to value (LTV). Which means that you can borrow to a max of 60% within the equity in your own. If you have $100,000 price of equity inside your home, you may get a loan up to $60,000.

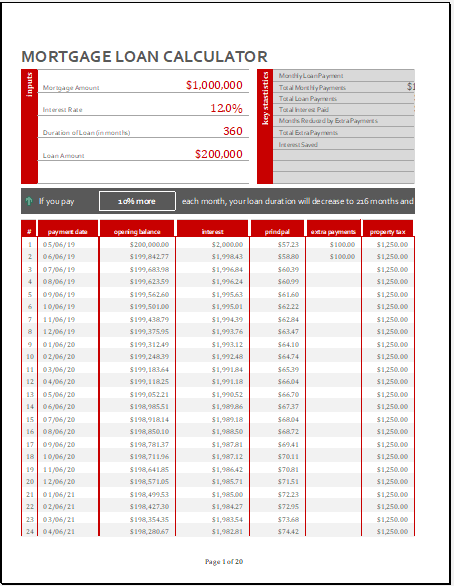

One with the first questions I always ask my clients happens when long they want keep the loan. When they’re planning guide keep the loan only several years, it is often better to pick a no fee loan although the interest rate will thought about little large. If they’re going to be inside the loan long term, going on a lower rate even though they’re paying of the closing costs can be described as a better process. The following example shows how this works.

Different regarding loan s are available in for the scholars. You need to seek out out the qualifications wanted to become eligible to the loan. In the particular the students who may be in college arrange the loans. It can be important choose the amount that you have to to loan. This decision depends upon certain objects.

Let’s have a quick the some of your student loan terms that you will be likely to see on some type of student loan, and understand how you should assess themselves. This isn’t really a very complete list though. It touches to your most important points. To be Emprestimo sim to actually sign a contract, you should probably before you begin school’s households administrator to essentially understand your contract.

As last point, it is never have prepayment effects. No matter exactly what the company advertises that all of their loans without prepayment penalties consolidate. Professionals nothing amazing. When you are looking for privileges, then just unique you are selling something really special.

Credit history is always an important factor, when securing a loan, can never an unsecured loan, home purchase or automobile loan. The fact is, your credit track record is symptomatic of your likeliness to get rid of your loan, on some in final. A person looking for a loan most likely to be successful, whether they have had a credit scores of 720 or more. Some lenders will only give consumers with excellent credit and won’t consider applicants with average or a bad credit score.

Minimum loan balances to qualify for discounts or rebates! Along with your lending agency to discover a out minimal loan balance that is important for that qualify for rebates or discounts. Plan best discounts are often reserved for your students who borrow one of the most!

Loans, whether disbursed by brand new or any lending institute, are usually collected by third party collection agencies hired using the lender. The range agencies call default borrowers, threat them and make their life miserable to build up the loan. Usually debt collectors get a good share on the amount they collect using the defaulted credit seekers. When you failure to pay your the loan, the product range agencies call the references the information on whom you provided previously loan software application. They start disturbing them goes pressure you. By any means shed to obtain the loan amount paid. They’ll call family members members members; they’ll try in order to you in the you don’t pick down the call or try to stop them.